New York Tax Brackets for the Married Filing Jointly Filing Type

After months of deliberation, New York State has finally passed its 2026 fiscal year budget. Originally due April 1, 2025, it goes down as the largest budget in the state’s history, totaling $254 billion. While it prioritizes investments across various sectors, including climate initiatives, childcare funding, infrastructure improvements, and public safety, there are various tax-related provisions. Below are some highlights of the key tax implications for the new fiscal year.

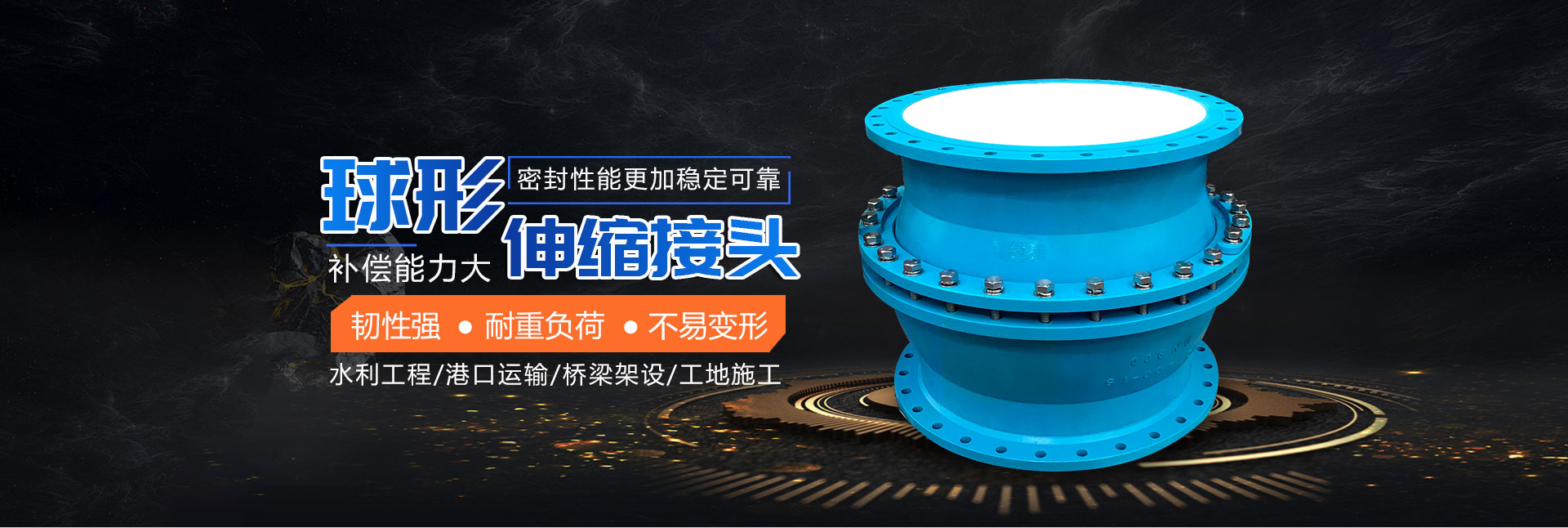

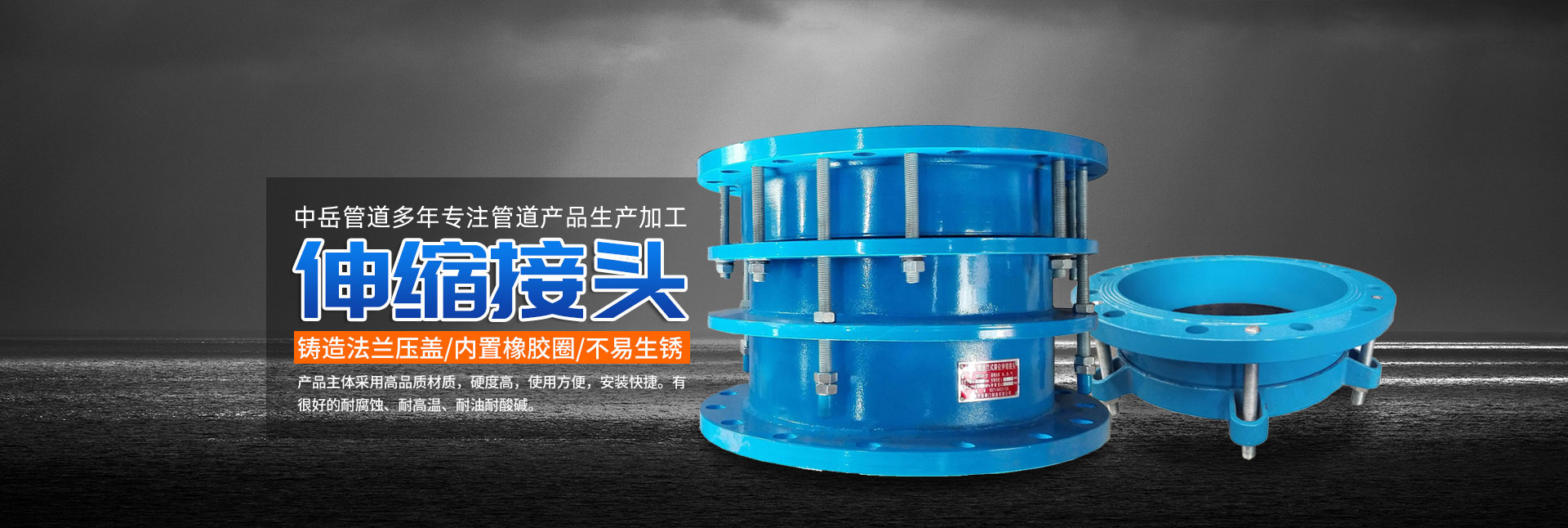

The 2026 bracket map you will see on pay stubs

These calculators take into account all the tax brackets and help you figure out exactly how much you owe. They can also help you see how different deductions or credits might affect your total tax bill. Here you can find how your New York based income https://www.publihen.com/bookkeeping/goods-receiving-notes-overview/ is taxed at different rates within the given tax brackets. When you prepare your return on eFile.com this is all calculated for you based on your income.

Wisconsin’s Proposed Retirement Income Exclusion Would Shift Tax Burdens to Working Families over Time

The Personal Exemption, which is not supported by the New York income tax, is an additional deduction you can take if you (and not someone else) are primarily responsible for your own living expenses. Likewise, you can take an additional dependent exemption for each qualifying dependent (like a child or family member), who you financially normal balance support. While these guidelines apply to most residents, specific exemptions may affect whether you need to file. TurboTax can help you navigate these rules and determine if any exceptions apply to your unique situation, ensuring you meet all filing requirements. These rules ensure you’re using the most accurate tax calculation method for your specific financial situation. Remember, when you file with TurboTax, we’ll help determine this information for you.

Empire state jobs retention program.

As part of its comprehensive tax reform, effective January 1, 2025, Iowa consolidated its three tax brackets into a single bracket with a rate of 3.8 percent, joining the group of states with flat individual income taxes. Marginal income tax brackets for Married filing jointly filers in New York for 2026. Because there are no deductions available for personal income tax, the best way to reduce the amount that you have to pay is to offset what you owe by deducting tax credits from your state income taxes. The following tax credits may help reduce the total amount of taxes that you pay. Filing jointly has many tax benefits, as the IRS and many states effectively double the width of most MFJ brackets when compared to the Single tax bracket at the same tax rate level.

- While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

- This means that in most cases, you will pay less income tax overall by filing jointly.

- Note that all five New York City counties (New York, Kings, Queens, Bronx and Richmond) are subject to the full city tax rate of 8.875%, the highest total rate in the state.

- The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

- However, all counties collect additional surcharges on top of that 4% rate.

- Because there are no deductions available for personal income tax, the best way to reduce the amount that you have to pay is to offset what you owe by deducting tax credits from your state income taxes.

Highest Selling Apartment in NYC

- Whether it’s new tax credits or changes in deductions, staying informed is an integral part of effective tax management.

- (NEW YORK) New York State will apply new personal Income Tax Rates for tax year 2026, cutting the five lowest rates by 0.1% while keeping top rates as high as 10.9% in place through at least 2032.

- The second option, and one which more and more people are choosing, is to live outside the city but commute to work daily.

- Starting January 2026, payroll withholding will reflect the first 0.1% reduction.

- Payroll systems generally build the new tables into the first pay runs of January.

- Understanding how your tax burden in New York compares with that of other states can provide valuable insights for relocation decisions or investment strategies.

Below is a breakdown of some of the deductions and credits you could potentially qualify for as a tax filer in New York state. The law extends the sales tax exemption for vending machine ny state tax brackets transactions to May 31, 2026. Buildings financed by certain refunded bonds are eligible for the low-income housing tax credit pursuant to IRC § 42(b)(2). The credit cannot reduce tax liability to less than the minimum tax, and any excess credit will be treated as an overpayment to be credited or refunded.

- This means that, if you’ve already tried offsetting what you owe with state income tax credits, you’re out of options for further reducing your taxes.

- The New York musical and theatrical production credit is also extended to January 1, 2030.

- Let’s delve into the specific tax brackets to see how this progressive system is structured.

- New York City and Yonkers also require residents to file local income tax.

- These calculators take into account all the tax brackets and help you figure out exactly how much you owe.

Whether you’re looking for business solutions, financial strategies, or industry insights, we’re ready to collaborate. Learn how to challenge property assessments and navigate appeals to lower annual taxes with CBIZ’s expert guidance. The IRS extends tax filing and payment deadlines to May 1, 2026, for Washington State taxpayers affected by recent extreme weather, with no late penalties. After more than a month of delays and extensions, New York State has finally passed its budget for the fiscal year that began on April 1 and will end on March 31, 2026.